Porter’s Five Forces: How to Think Like a Business Strategist in Any Industry

Aug 26, 2025

If you’re in business and you don’t understand the forces working for or against you, you’re playing blindfolded. You might have a great product, a killer team, and some early wins—but that doesn’t mean you’ll survive.

Markets aren’t kind. Competitors are ruthless. Customers are picky. Suppliers are powerful. And new threats emerge constantly.

That’s where Porter’s Five Forces comes in. This isn’t just MBA jargon. It’s a tool—one of the most valuable strategic frameworks ever created—and it helps you understand the battlefield before you charge into it.

Let’s break it down the Myford way—using the Five W’s and One H approach:

What is it?

Why does it matter?

Who should use it?

When do you apply it?

Where does it show up?

How do you use it to make better decisions?

- What Is Porter’s Five Forces?

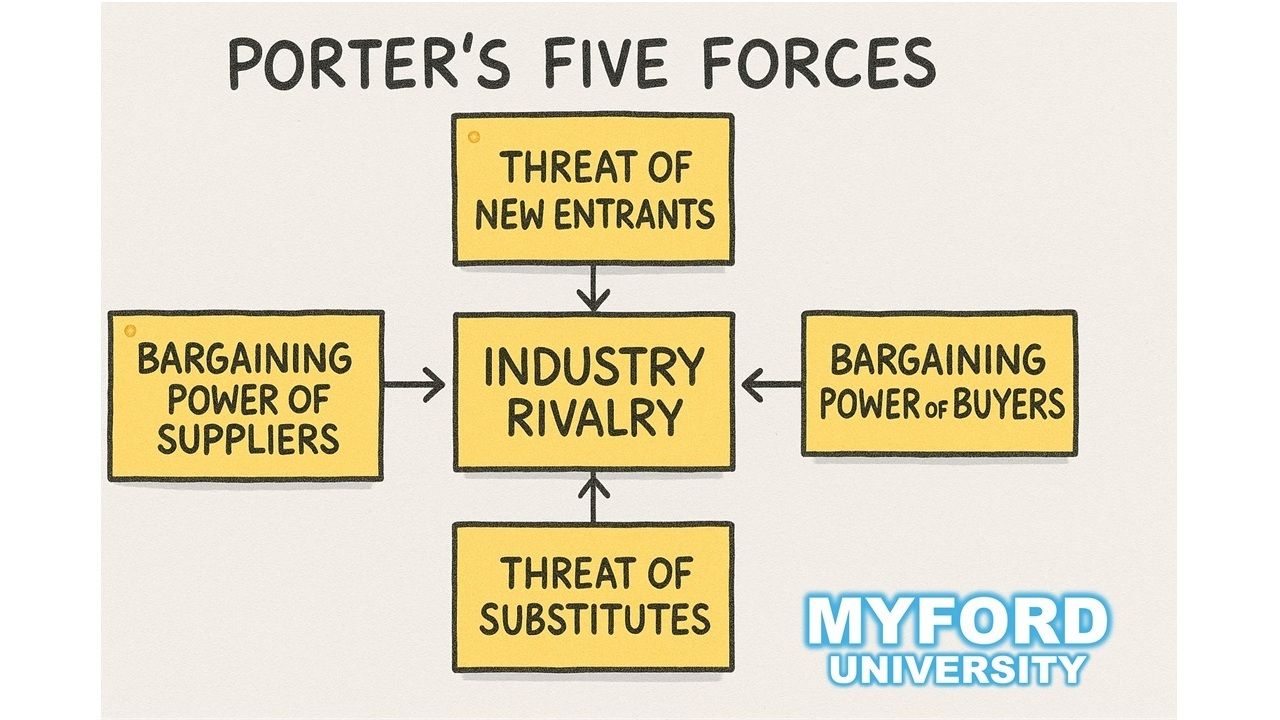

Porter’s Five Forces is a framework for analyzing the competitive dynamics of an industry. Developed by Harvard professor Michael Porter in 1979, it identifies five forces that determine the profitability and attractiveness of any market or sector.

Here are the five:

- Industry Rivalry – How intense is the competition?

- Threat of New Entrants – How easy is it for others to enter your space?

- Threat of Substitutes – Can customers switch to alternatives?

- Bargaining Power of Buyers – Can customers dictate terms?

- Bargaining Power of Suppliers – Can suppliers squeeze you?

The core idea: These five forces collectively determine whether you’re in a market where profits are easy to earn—or nearly impossible.

It’s not just about who your competitors are. It’s about how much power each stakeholder has, and how much of your margin they’re quietly eating.

- Why Does Porter’s Five Forces Matter?

Because strategy isn’t just about doing things right—it’s about picking the right battles.

Porter’s Five Forces helps you answer essential questions:

- Should we enter this market?

- Can we raise prices?

- Are we too dependent on suppliers?

- Will a new competitor wipe us out?

- Are we vulnerable to cheap substitutes?

Here’s the blunt truth:

Many businesses don’t fail because they’re bad at execution.

They fail because they enter unwinnable arenas—markets with brutal dynamics where even the best players struggle.

This framework helps you see around corners. It helps you stop reacting and start strategizing.

- Who Should Use Porter’s Five Forces?

This isn’t just for Fortune 500 companies or Harvard case studies. Anyone who wants to understand, evaluate, or compete in a market should be using this model.

That includes:

- Entrepreneurs thinking about launching a product or business

- Investors analyzing a sector or potential acquisition

- Product managers deciding whether to pivot

- Corporate strategists plotting market expansion

- Small business owners facing new competition

- Marketers trying to justify pricing and positioning decisions

Bottom line: If you sell, build, compete, or invest—you need this lens.

- When Should You Use the Five Forces?

Use it at every critical business decision point, especially when:

- Entering a new industry or market

- Launching a new product or service

- Facing declining profits or margins

- Considering mergers, acquisitions, or partnerships

- Reevaluating your competitive strategy

This isn’t a one-time academic exercise. You should revisit the forces regularly, because industries shift—new technologies, regulations, competitors, and customer behaviors constantly change the game.

If you’re still using a five-year-old strategy in a fast-moving space, you’re already behind.

- Where Does Porter’s Five Forces Show Up in Business?

It shows up in boardrooms, consulting decks, investor pitches, business school cases, and war rooms before major product launches.

But it should also show up:

- In your competitive research doc

- On your business plan or pitch deck

- In your market entry analysis

- As part of your SWOT analysis (hint: many of the “threats” in SWOT come directly from Porter’s Five Forces)

It’s a strategy tool—but also a communication tool. Use it to convince investors, align your team, or make smarter decisions when resources are tight.

- How to Apply Porter’s Five Forces (Step-by-Step)

Let’s break down each force and show you how to apply it—with simple questions and real-world examples.

🔹 Force 1: Industry Rivalry

What to look at:

- How many competitors are there?

- Is market share fragmented or concentrated?

- Are products differentiated or similar?

- Is price competition fierce?

High rivalry = low profits.

Example:

The airline industry has brutal rivalry. Too many players, little product differentiation, and heavy price wars. It’s why many airlines struggle—even when seats are full.

Your move:

Can you differentiate? Build brand loyalty? Operate more efficiently? If not, think twice.

🔹 Force 2: Threat of New Entrants

What to look at:

- How easy is it for someone to start competing with you?

- Are there high startup costs?

- Are there regulatory hurdles?

- Are economies of scale required?

Low barriers = high threat.

Example:

Starting a dropshipping store takes almost no capital or licensing. Anyone with Wi-Fi can become your competition overnight.

Your move:

Build moats—brand, community, proprietary tech, economies of scale, long-term contracts. Make entry harder.

🔹 Force 3: Threat of Substitutes

What to look at:

- Can customers switch to a different solution easily?

- Are substitutes cheaper or more convenient?

- Are customer switching costs low?

More substitutes = more pricing pressure.

Example:

Streaming platforms are substitutes for cable TV. Coffee at home is a substitute for Starbucks. Uber is a substitute for car ownership or public transport.

Your move:

Focus on unique value, experience, or bundled benefits to make switching feel like a downgrade.

🔹 Force 4: Bargaining Power of Buyers

What to look at:

- Can customers negotiate on price?

- Are they concentrated or fragmented?

- Can they switch providers easily?

- Are your products commoditized?

More buyer power = lower margins.

Example:

Large retailers like Walmart or Costco have enormous bargaining power over suppliers—they can demand price cuts, better terms, or even exclusivity.

Your move:

Differentiate. Offer value that goes beyond price—speed, support, features, customization.

🔹 Force 5: Bargaining Power of Suppliers

What to look at:

- How many suppliers do you depend on?

- Are they large or niche?

- Are there switching costs?

- Can they vertically integrate?

Few powerful suppliers = major risk.

Example:

Apple once depended heavily on a small number of chip manufacturers. Any disruption could impact supply chain and costs.

Your move:

Diversify suppliers. Lock in contracts. Develop your own components if possible.

Real-World Example: Applying the Five Forces

Let’s say you’re thinking about starting a high-end organic energy drink brand.

Here’s a quick Porter’s Five Forces snapshot:

- Rivalry: High – Monster, Red Bull, Gatorade, and hundreds of smaller brands.

- New Entrants: Medium – Barriers are moderate (formulation, shelf space, distribution deals).

- Substitutes: High – Coffee, water, supplements, smoothies, even just sleep.

- Buyer Power: High – Retailers control shelf space; customers are price-sensitive.

- Supplier Power: Low to Medium – Many ingredient vendors, but premium organic sourcing narrows options.

Verdict:

Tough space. Unless you bring something truly different to the table—unique formulation, cult brand appeal, viral founder story, or exclusive channel strategy—you’re walking into a meat grinder.

That doesn’t mean “don’t do it”—but it does mean know what you’re up against and prepare accordingly.

Final Thoughts: Don’t Just Compete—Understand the Game

Most businesses fail not because they’re lazy or untalented—but because they didn’t understand the market they were walking into.

Porter’s Five Forces helps you stop acting like a technician and start thinking like a strategist.

Here’s how to apply it starting today:

- Print the Five Forces

- Ask the key questions under each

- Score each force (Low, Medium, High)

- Use it to inform your go-to-market, pricing, and competitive moves

If you’re in a high-force market, you need stronger execution, better differentiation, and smarter strategy just to survive.

If you’re in a low-force market, you’ve got breathing room—but don’t get lazy. Moats can shrink fast.

At Myford University, we train you to think like a business strategist—not just follow playbooks. Porter’s Five Forces isn’t just theory. It’s a tool you should revisit every time you launch, pivot, or scale.

So before you make your next big move—analyze the forces.

Stay connected with news and updates!

Join our mailing list to receive the latest news and updates from our team.

Don't worry, your information will not be shared.

We hate SPAM. We will never sell your information, for any reason.